Receive our news

Subscribe to our monthly newsletter

As mentioned in our previous article, the COVID 19 pandemic has had a significant negative impact on the global economy; it is the worst recession since World War II.

However, it is not all doom and gloom, especially for the marketplaces, which have, on the whole, performed particularly well in 2020. This is what we will explain in this article and highlight current and future trends.

According to initial estimates, in 2020, France will have exceeded the €115 billion mark in e-commerce turnover (7).

As a result of government directives that are putting physical stores under pressure, there has been a fairly logical shift from physical to digital sales. Traditional retailers in Europe have seen their sales fall by 60% over the year (6).

Thus, new digital consumption trends are emerging and becoming more pronounced, particularly in niche markets such as luxury goods or more technical sectors such as vintage cars.

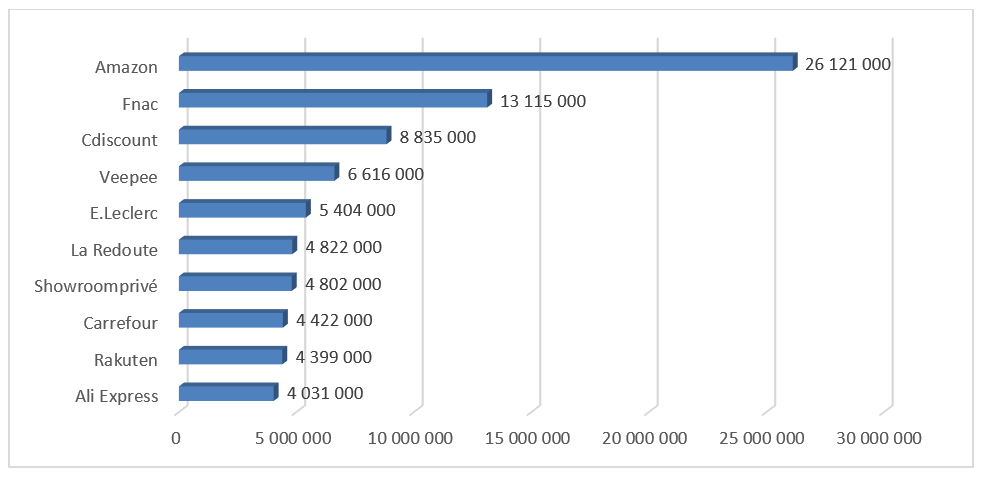

Top 10 marketplaces in France in 2020 by number of customers published by emarketerz: (5)

According to initial estimates by the emarketerz website, 7 of the top 10 players are French.

They are redoubling their efforts to capture and retain the ever-volatile customer base. For example, Carrefour, which launched its platform in June 2020, highlights local producers according to the geographical location of the connected customer.

However, the big winner is, as it is every year, the American Amazon with more than 26 million French customers in 2020(5).

Globally, Amazon remains the leader despite the difficulties the company faced in 2020 due to the COVID-19 crisis.

Indeed, in order to relieve the logistics teams and to respond to the massive increase in the need for essential products, the company has decided to postpone the following projects and services (1)

Due to the priority given to essential products in Amazon warehouses, other products could not be offered for sale.

Sellers with the ability to ship themselves took all the sales. This not only disadvantaged sellers in the FBA programme, but also brands in retail who saw their orders stop overnight.

To address this disparity, Amazon has made it easier for sellers to sign up for the Prime Sellers Program, which allows sellers to offer the Amazon Prime service by shipping their products directly.(1)

Nevertheless, this still benefited all third party sellers on the platform who increased their sales by 47.5% from $200 billion in 2019 to $295 billion this year globally.(1)

In terms of new sellers, the US marketplace was less attractive. The number of new sellers remains the same as in the previous year.(1)

Existing sellers already have thousands of ratings on their items, which gives them an advantage in search results and creates a barrier to entry for new players.

The biggest sellers therefore remain those who joined the Amazon universe in 2017.(1)

Another big change for Amazon is the role of Chinese players as sellers.

Hit hard by the COVID-19 crisis, China drastically reduced its production from February to May, thus impacting not only their sales but also those of Western companies sourcing there.(1)

However, the business has subsequently picked up. By the end of 2020, 42% of Amazon's top sellers are Chinese.

This is partly due to their ability to adapt quickly due to their roles as historical providers for Western brands.(1)

To penetrate this market, Chinese suppliers create their own brands, which they launch on Amazon to take advantage of the platform's visibility.

After many years of Digital Native Brands (DNBs), we are seeing a new model: Amazon Native Brands (ANBs).

They are becoming increasingly important because of their ability to compete with the leaders in their target markets.

The best-known example is Anker, a company launched in 2011 on Amazon, which sells charging solutions for laptops and tablets.

It competes with the historical premium manufacturers and has even achieved a turnover of 1 billion dollars in 2020. Thanks to the notoriety generated on this platform, it has managed to diversify its distribution channels by establishing itself directly in traditional Bricks And Mortar stores.(1)

Finally, despite the COVID-19 crisis and the low growth in the number of new sellers compared to previous years, Amazon has just launched its business in Sweden with 40,000 foreign brands present at the launch. However, only about 100 Swedish brands have responded.(1)

Despite the efforts of the American giant to retain its extremely volatile customer base and attract new sellers, it has not been completely successful.

Amazon's competitors have also been able to expand their business due to the transfer of customers.

However, some players, such as eBay and Wish, have not been able to make the most of the opportunity because they do not differentiate themselves sufficiently from the market leader. They present the same global consumer offer.(1)

It is therefore in differentiation that we find the most successful competitors. Specialised marketplaces stand out either by their exclusive offers, as in clothing. Or by positioning themselves on a niche market, such as the Mano Mano company in the field of DIY.

Other types of services have also emerged during the year 2020: handmade and C2C sales.

Marketplaces such as Etsy or Vinted have indeed exploded in popularity and sales overall. This is due, on the one hand, to the recognition of more sensible consumption and, on the other hand, to the shortage of basic necessities.

For example, the American company Etsy used the designers on its platform to create and offer masks to customers who had difficulty obtaining supplies.

In this way, Etsy has gained popularity by attracting new customers and, as a result, 1.9 million new sellers. As a result, the company has increased its revenues by 127% in the year 2020.(1)

Another trend of the year is the customer shopping experience geared towards the demographic most likely to buy online: the Milennials. We are talking about the internalised buying process.

In response to this trend, Google, Facebook and Instagram launched respectively Buy On Google in 2015, Marketplace in 2016 and Checkout in 2019. (3), (9), (10)

The COVID crisis of 2020 has created many challenges and opportunities for platforms, vendors and customers alike. There is an acceleration of the change in consumption and sales habits. This will result in a further increase in the share of the e-marketplace in 2021.

Let us be aware that this development will not only be quantitative but also qualitative.

Customer experience is crucial in all areas of the economy, but particularly in marketplaces where customers are highly volatile. Thus, responding to their needs by creating an integrated, comfortable, efficient and value-driven sales experience is key to building customer loyalty.

In our view, it will continue to involve improving the logistics service to meet the needs of national and international crises as we saw in 2020.

But it will also be necessary to continue to give visibility to local, handmade and small-scale sellers in order to propose a varied, personalised, authentic and human offer.

Sources :

(1) https://www.marketplacepulse.com/marketplaces-year-in-review-2020

(2) https://www.journaldunet.com/ebusiness/le-net/1071394-nombre-d-internautes-en-france/#:~:text=According%20M%C3%A9diam%C3%A9trie%2C%20la%20France%20comptait,5%25%20of%20the%20population%20fran%C3%A7aise.

(4) https://www.blogdumoderateur.com/chiffres-cles-e-commerce-2020/

(5) https://www.emarketerz.fr/top-10-e-commerce-france-2020/

(6) https://www.sendcloud.fr/top-15-tendances-e-commerce-2021/

(7) https://www.oberlo.fr/blog/meilleurs-sites-vente-en-ligne

(9) https://www.marketplacepulse.com/articles/google-shopping-is-not-attracting-sellers-despite-0-fees

Do you have more questions or would you like to challenge us on your brand issue?