Icebreaker case study – The cost of the lack of knowledge

How not being supported by Amazon specialists can affect strongly your businesses

Interview of Nils Guicherd:

Ex-Key account manager at Icebreaker

Now guiding you to avoid mistakes at Sellingz

Icebreaker Amazon case study

Contexte

A premium brand growing on Amazon without marketplace strategy

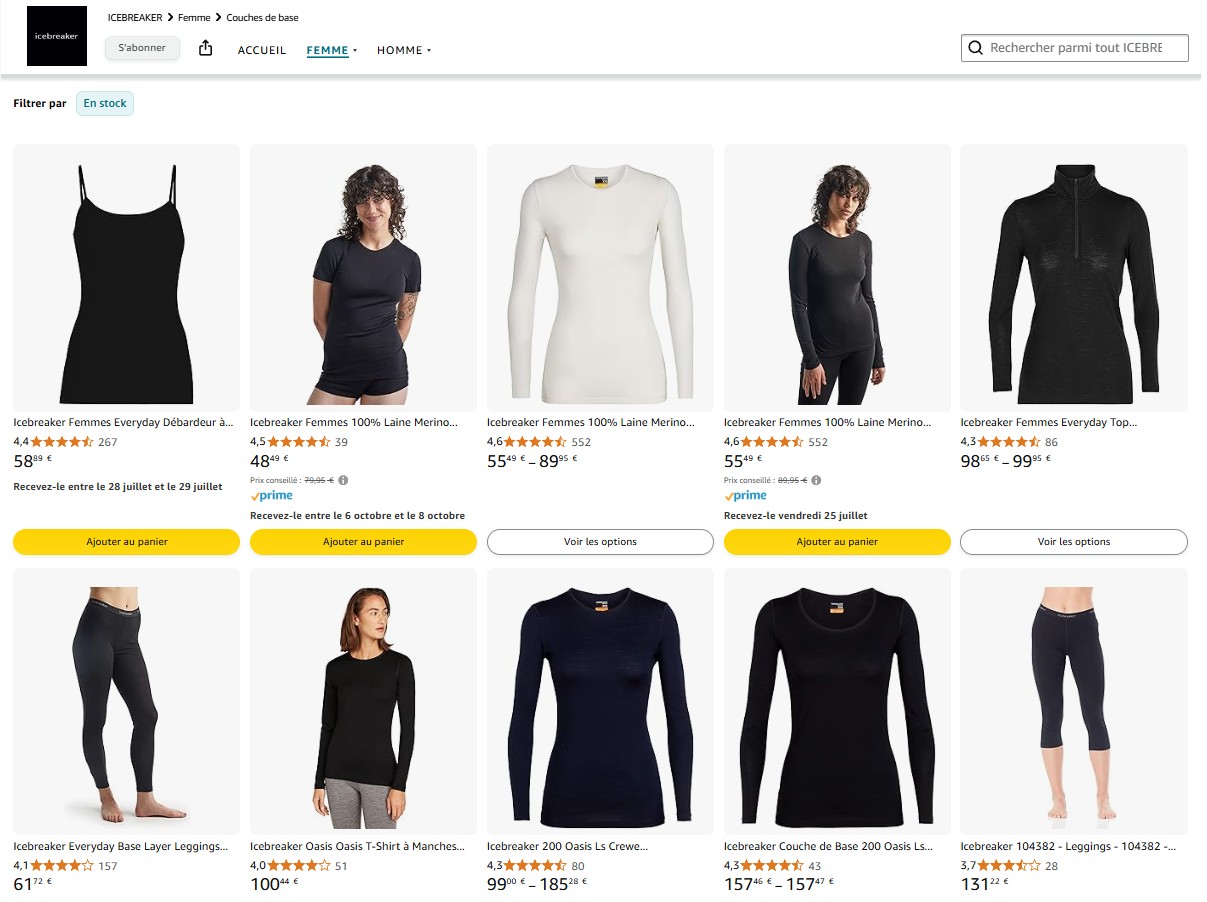

Icebreaker is a premium performance apparel brand known for its natural merino fibers. In 2019, they generated a 7-digit number in sales on Amazon across Europe in Vendor mode. Amazon was generating strong performances and growth since the beginning of the collaboration, 5 years before. They reached this figure with relative ease.

The account logically moved to a PanEU management in 2020 with the lead naturally given to the brand’s biggest market, Germany. Basics of a Pan-EU account were well implemented, promising great account success.

They had:

- uniform commercial agreements across every EU country,

- same marketing strategies and coop budget,

- an aligned catalog logic across all markets.

At that time, Icebreaker was used to traditional B2B models and structured e-retail relationships. No one had specific Amazon knowledge in the brand.

“We knew what we learned on our own by using the Vendor platform & by our external knowledge about e-commerce & e-tailers customers”. Nils, KAM.

In short, Amazon was seen as “just another e-retailer” and managed accordingly.

Initial issues: underestimating Amazon’s mechanics

Despite good intentions, several fundamental mistakes were made—rooted in a lack of channel-specific knowledge. Ultimately, this led to the closure of the Amazon account for a while:

-

Misunderstanding ASIN lifecycle dynamics

Amazon rewards longevity. Older ASINs accumulate clicks, reviews, and conversion history, boosting ranking.

Icebreaker’s seasonal product renewal meant constantly resetting the algorithmic momentum—without deploying a launch strategy (ads, Vine, cross-variation linking) to offset it. Launching a new product is costly on Amazon and we didn’t understand it because our traditional e-tailers want and love new products.

“We saw that our basics SKUs were better performing on Amazon than seasonal ones, but we didn’t understand what it took to launch a new product and the algorithm requirements to succeed. We thought catalog SEO would be enough. And we kept feeding new products every season on Amazon because this was the way we did with other customers. Nils, KAM.

-

No channel segmentation

The same assortment was sold to both Amazon and traditional wholesale clients. Even when choosing basic products for the Amazon assortment, they were still in competition with most of their retailers who also needed some basics in their assortment.

This triggered:

-

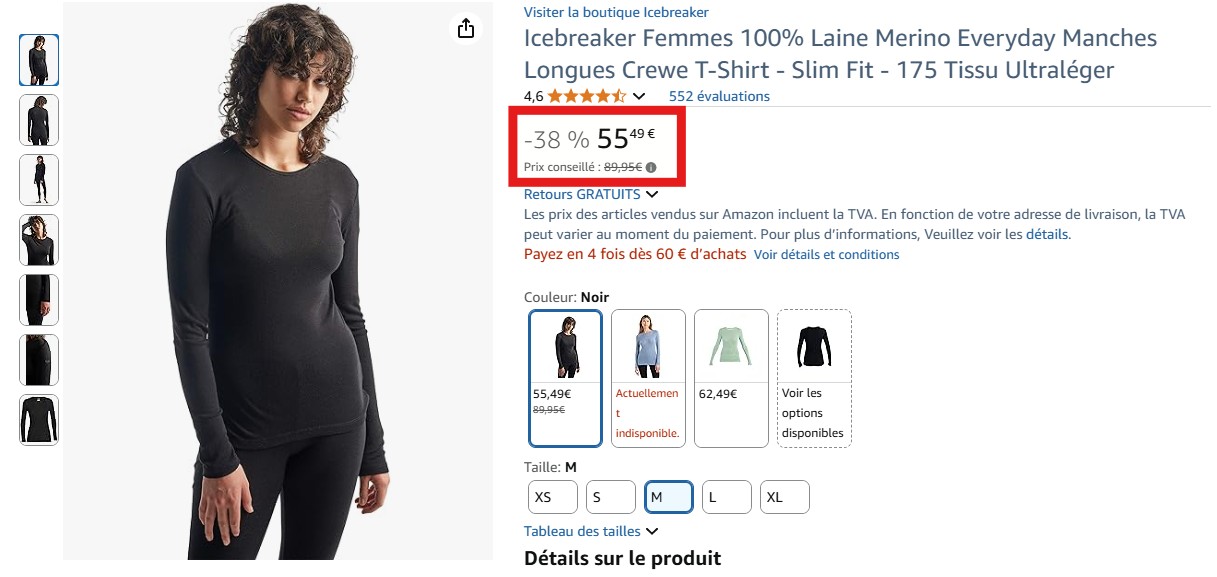

- Buy Box conflicts and algorithmic price matching

- Tensions with B2B retailers due to Amazon’s lower prices

- Loss of control over pricing

“My key e-tailers such as Snowleader & Ekosport where constantly complaining about prices of Icebreaker on marketplaces. Even if basics were not core to their assortment, they had demand but lost sales potential quickly in the season because of Amazon prices.” Nils, KAM

-

Poor ASIN transition management

When basic core products were renewed in 2020 (a minor update which created an EAN change), the new ASINs were launched with not enough transition support. Although legacy and new listings were technically linked, there was no:

-

- Ads investment to drive visibility of the new ASINs

- Vine program to generate early reviews

- Variation logic to connect the listings properly

- Thoughtful split of old vs new references to protect pricing

- Naming strategy to differentiate products

“We just didn’t know all of this was needed to recreate the same business on our basics. We thought they were performing because they were “basics” but it was due to their sales history.” Nils, KAM

-

A premium brand reluctant to participate to Amazon deals

Flash sales on deals help product launch on Amazon, driving a better ranking for a full price business the rest of the season. Not taking part into these deals when you launch a new product weighting 65% of your turnover is a dangerous game.

For premium brands, short and controlled deals—especially during launch windows—can drive visibility and sales without harming long-term brand positioning. Icebreaker, like many premium labels, was reluctant to participate in Amazon-led flash deals, viewing them as image-damaging.

“Our thoughts were like this: Amazon is already asking for generous sales terms, including marketing budget. We won’t fund their black Friday on top of it. But looking back, it would have kickstart the product to avoid the upcoming failure and eventually drive better Net PPM for Amazon, hence more sales and easier Vendor negotiations.” Nils, KAM

-

Not enough knowledge about Amazon Ads:

While brand content such as A+ pages and Brand Store were correctly managed, advertising—a core pillar of Amazon performance—was underestimated. The internal team experimented with keyword types (brand, category, competitor), but without the tools or skills to monitor and optimize campaigns daily.

There was no segmentation by objective (visibility vs. conversion), no geographic or seasonal tailoring, and no budget prioritization by product type. Without AI-driven bidding, tracking, or performance dashboards, the campaigns lacked precision & performances.

Harsh consequences on a flourishing business

This lack of knowledge about Amazon & marketplaces in general led to a collapse in sales. Icebreaker experienced extremely poor sell-through on their new ASINs, and divided by 4 the purchase volumes the following year. This initiated a downward spiral.

Eventually, the brand chose to exit Amazon entirely for a few years as they wouldn’t be profitable anymore working with Amazon for such small business remaining.

It could be seen as an opportunity to drive a more premium, cleaner business for other retailers. But Amazon needs to empty their stocks and they had no more support from the brand to do it properly. Therefore, prices were even worse for years, the time that the full stock was cleaned. In the meantime, some retailers also uploaded their own stock online, leaving the brand exposed and the premium retailers still unhappy.

Financial impact : Millions lost and channel shut down

For a company of few dozen M€ of global revenue in EU, Amazon represented nearly 4% of turnover. This potential was eventually lost not to poor demand, but to strategic misalignment.

The end result:

- Amazon stopped placing orders, full revenue evaporated in 12 months

- Traditional clients remained unsatisfied due to persistent price conflict until total Amazon clearance

- A high-potential channel was abandoned instead of optimized

Icebreaker Amazon case study

Reflection : What could have been done differently?

This case isn’t unique. Like Icebreaker, about 30% of the brands stop momentously or permanently their Amazon activity after a few months or years.

Most brands entering Amazon don’t have a platform-specific expertise and underestimate the structural differences. Amazon is not a traditional e-retailer. Its pricing algorithms, catalog logic, and data-driven operations demand a different skillset—and ignoring that can cost millions.

Today, with my current role at Sellingz, I clearly see how tailored support could have preserved the channel, protected margins, and sustained long-term growth. This situation could have been avoided with more knowledge & support.

This is where a specialized partner like Sellingz could have made a difference. By understanding how marketplaces work, the agency is able to help brands setup an optimized, long-term strategy, on marketplaces:

- Catalog segmentation: here, the SKU update would have been a great opportunity to maintain Amazon on old SKUs and move all other retailers to new basics. Therefore, price matching would no longer apply and product performance would not only maintain, but get even better as distribution would clean itself from its old EAN codes, leaving this powerful Basic to Amazon with no more competition. Net PPM of Amazon would have improved, creating a better climate for preorder negotiations.

- Catalog management: SEO optimization, image optimization, maintaining a premium branding with A+ & brandstore.

- New product launch strategy with Vine reviews program, product association…

- Ads management with smart keyword and bidding strategies powered by AI

- Stock management to avoid OOS and overstock of Amazon during low season

Don’t leave millions on the table

Structuring your Amazon channel is not just about pushing catalog data and ads—it’s about protecting your brand while building a sustainable, segmented, and profitable revenue stream. This require expertise. We are here to help.

Tailored strategies designed for your brands

Contact us today for a personalized consultation tailored to your brand’s unique needs. Let’s discuss how we can help you succeed — book a meeting!