Receive our news

Subscribe to our monthly newsletter

One year was enough for the Hydrapak brand to (re)take over Amazon in Europe as an Amazon Vendor.

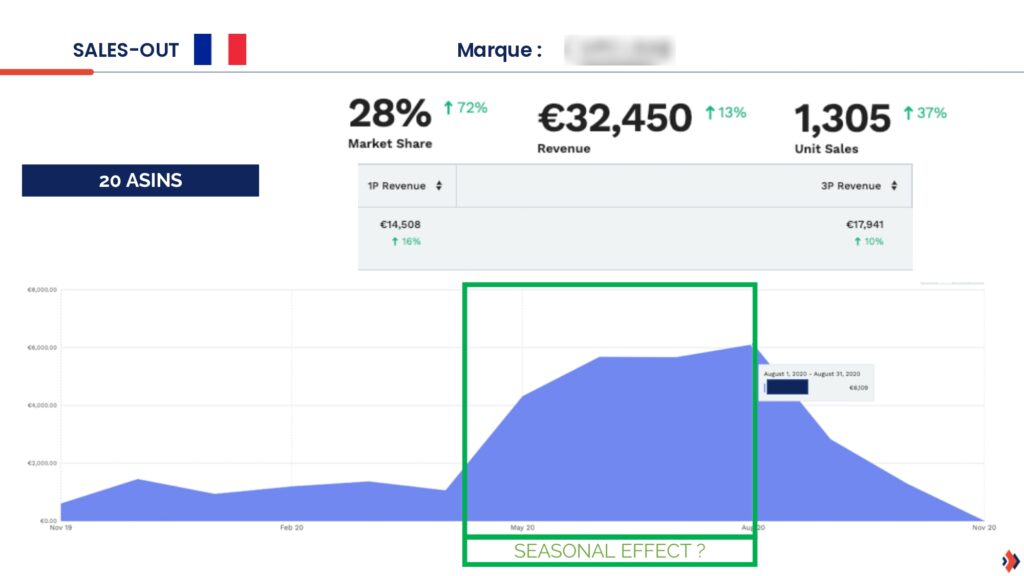

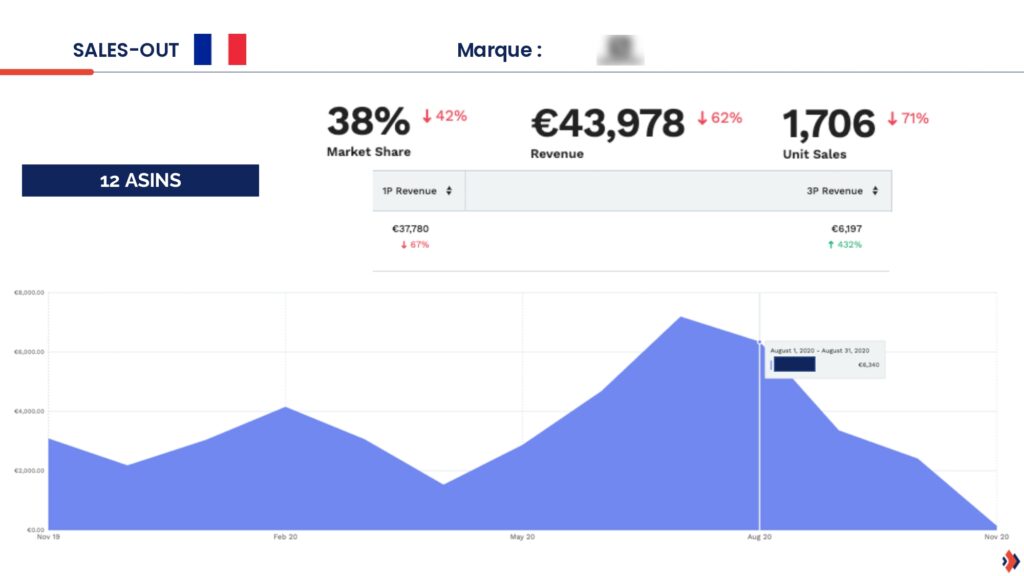

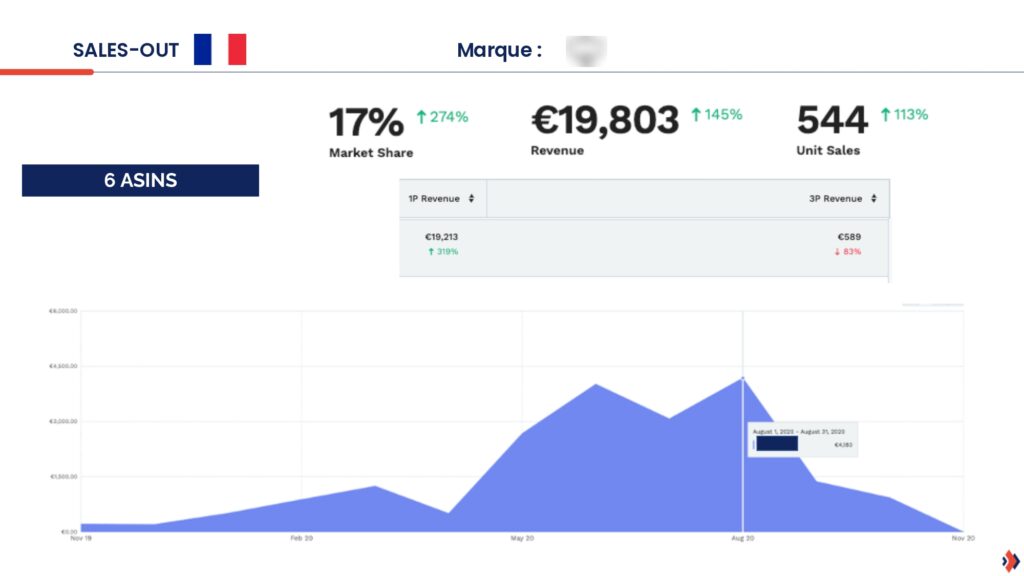

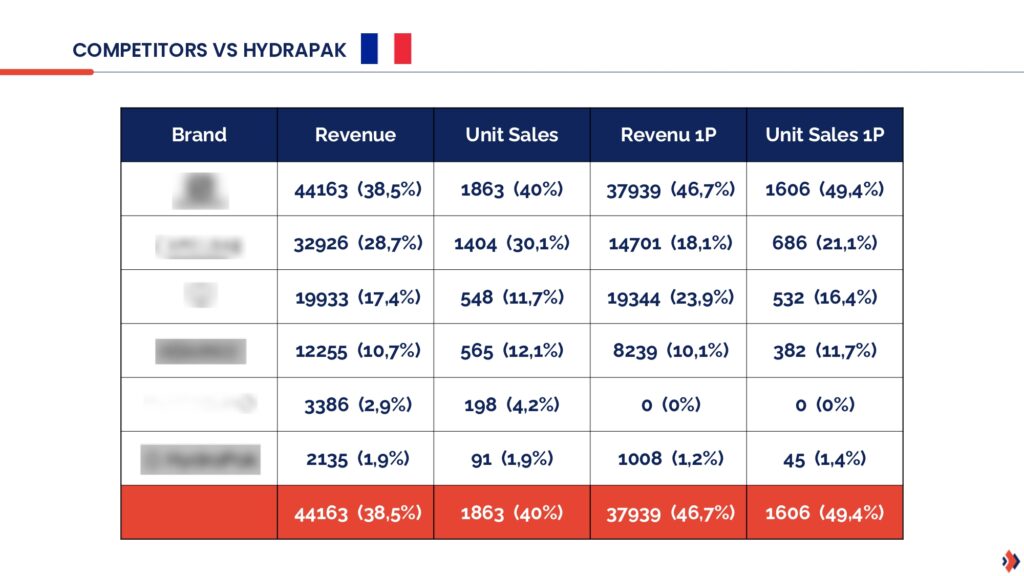

Judge for yourself: between January and December 2021, the brand grew by +53% in value and +61% in volume (Sell-out) on Amazon Retail, compared to -49% in value and -45% in volume for its third-party retailers.

This development was made possible by an Amazon market audit carried out at the end of 2020 by the experts Sellingz.

Explanations.

At the end of 2020, the Hydrapak brand asked us about its commercial potential on Amazon Retail (1P). Already indirectly present on Amazon through marketplaces (3P), it wishes to regain control of its sales.

We then propose to carry out a market study to :

The audit carried out by Sellingz aims to understand :

To prepare for the audit, we meet with Hydrapak for a kick-off meeting that will help us to have a clear idea of the objectives and results that the brand expects from the audit.

This first kick-off meeting helps us to define :

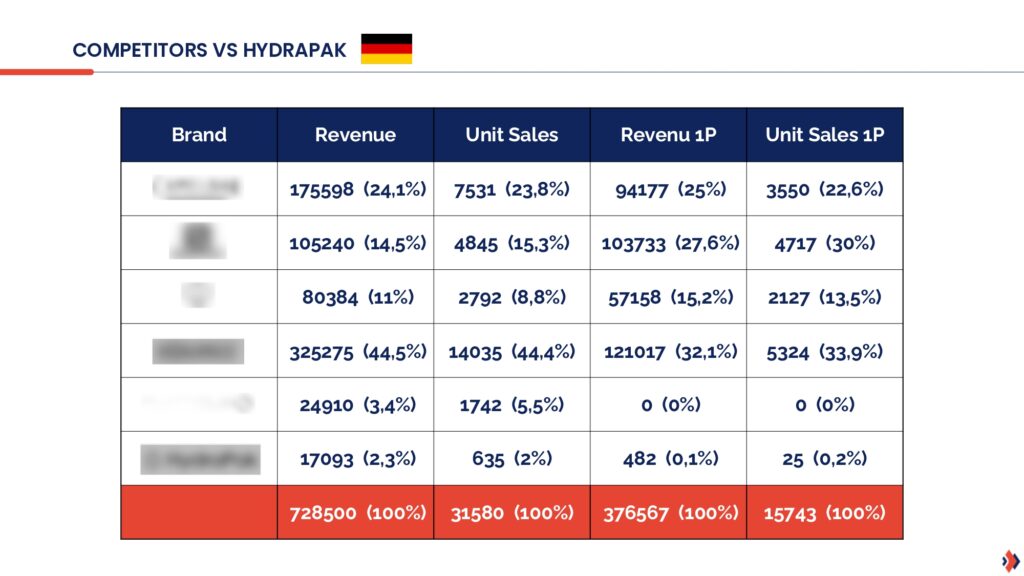

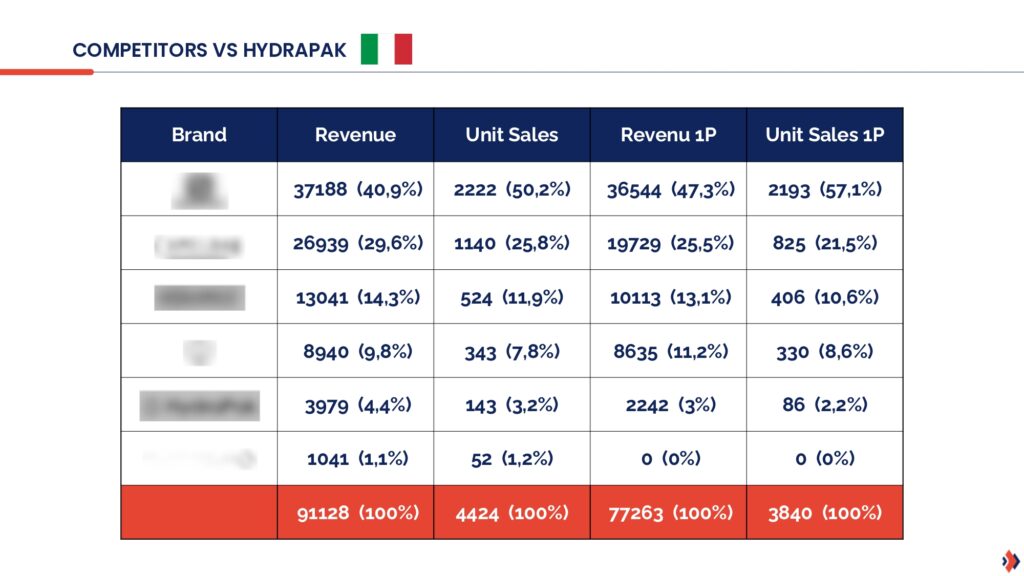

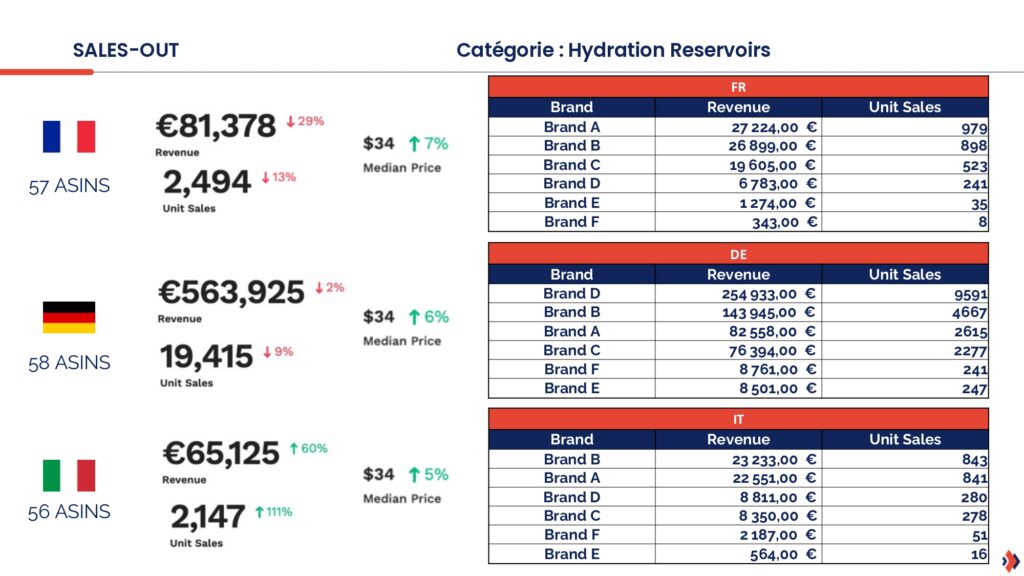

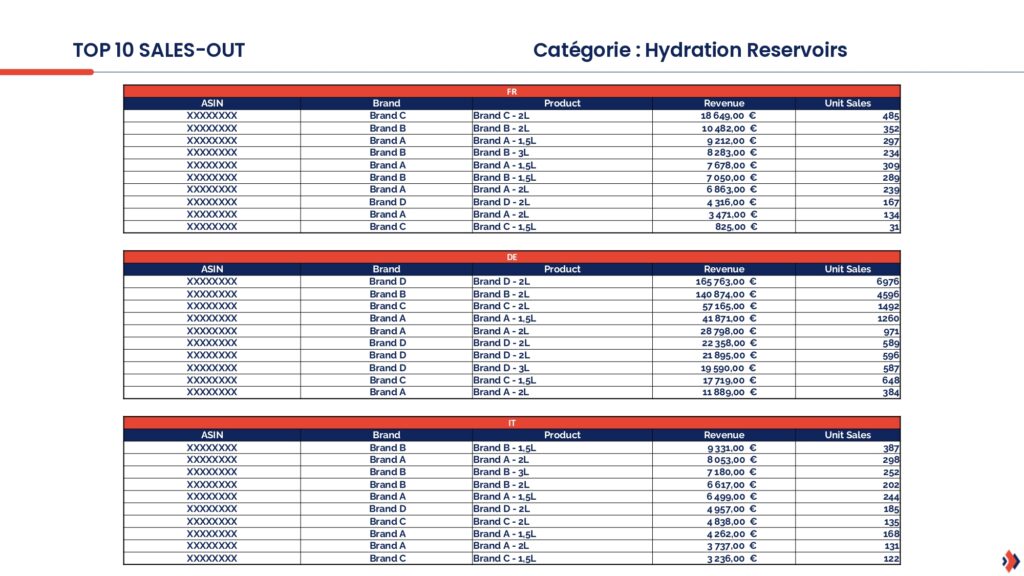

Armed with all this information, Sellingz sets up various business intelligence tools to gather data on :

Once the data has been collected, we assemble and analyse it as a whole to get a global view of the market.

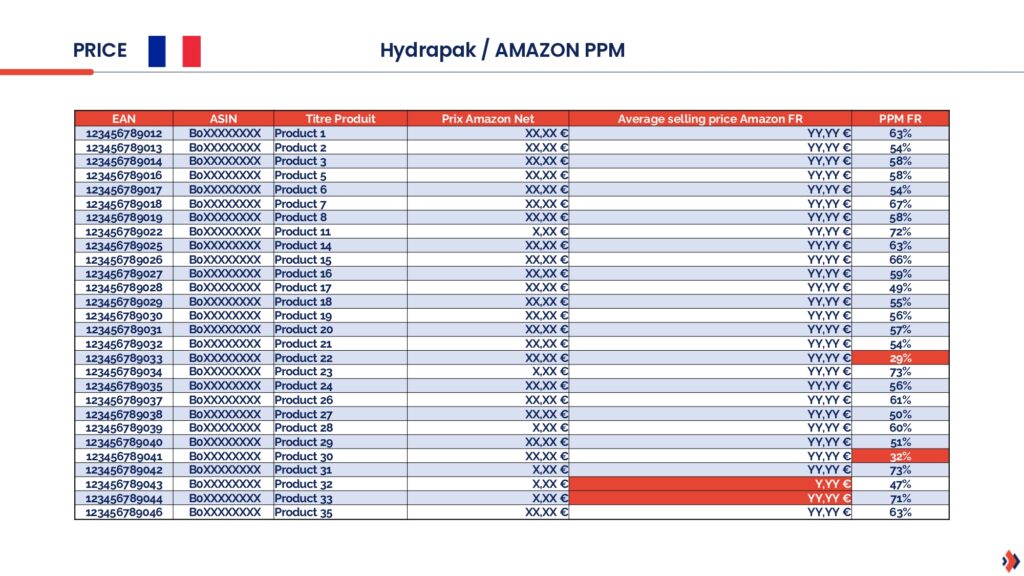

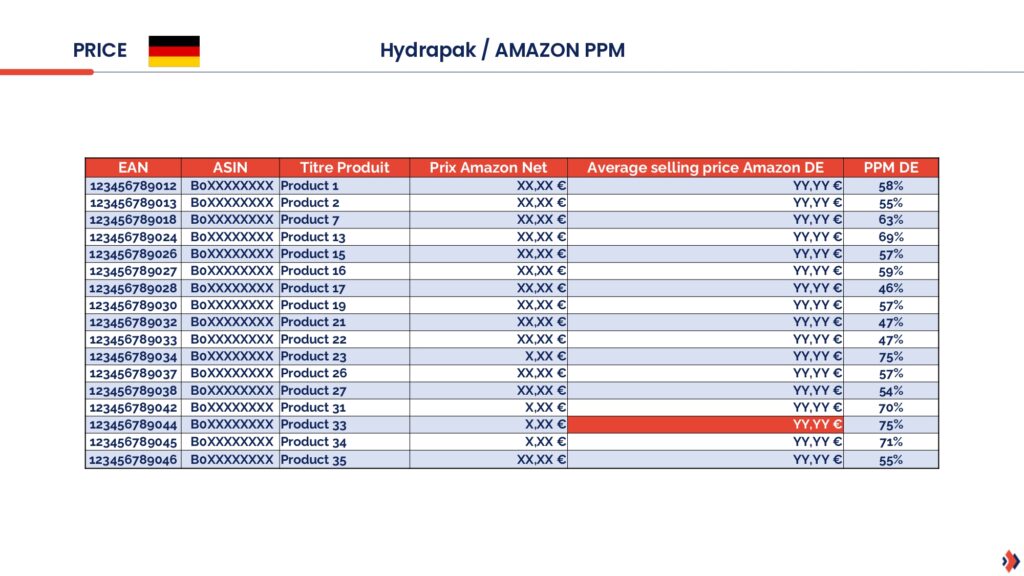

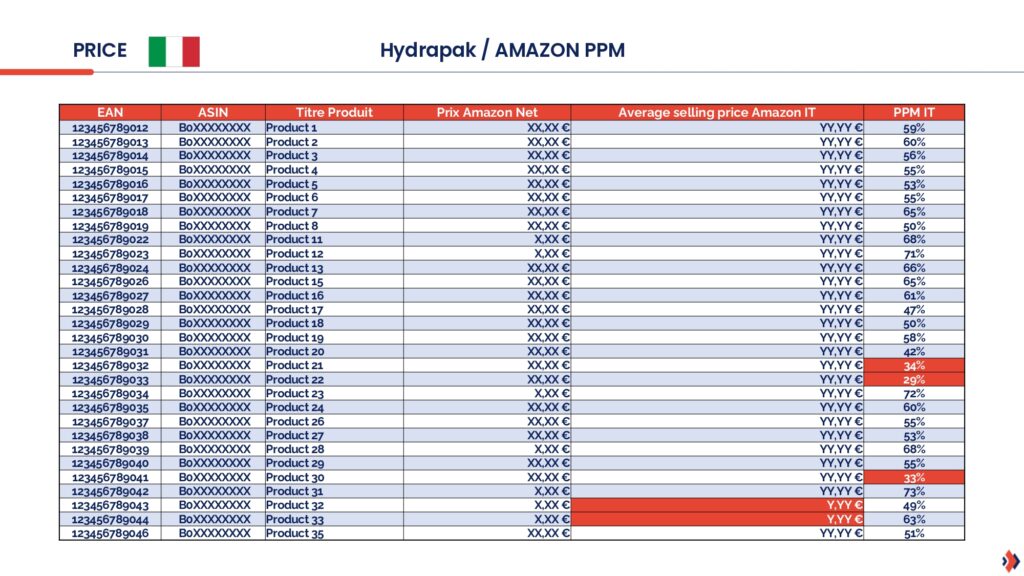

This gives us an understanding of how certain brands control the marketing of their products on Amazon by product category, price and country.

The analysis of the data allows us to carry out simulations with the aim of a specific Amazon Vendor strategy for the Hydrapak brand products.

The experts Sellingz shared with Hydrapak their strategic recommendations on :

The Hydrapak brand now has the strategic information to establish a concrete action plan to regain control of its sales on Amazon Europe. It knows how to get started, what results it can achieve and with what budget.

Following the Amazon Marketplace Audit carried out by our experts, the Hydrapak brand has been confirmed to be interested in launching actions on Amazon Vendor Central.

In view of the results obtained at N+1, it is clear that the audit Sellingz enabled him to seize a very good opportunity to develop his turnover by taking control of his sales on Amazon Vendor Central.

Hydrapak products are now properly sold by Amazon. From 101 ASINS at the beginning of the year, the brand has grown to 155 ASINS, allowing for a wider and therefore more interesting offer for the end consumer. This has resulted in a substantial increase in reviews and ratings.

*We have deliberately hidden the names of the various brands mentioned for reasons of data confidentiality.

Want to know your business potential on Amazon? Let's talk about it!